Seller’s Closing Costs Explanation

Closing costs for sellers and buyers have many variables: state, county, lender, title insurance company, contract sales price, broker, and more. Each and everyone has a different cost that has a variable and in that variable another variable. Please understand this is being provided as a courtesy and in no way should you hold Joe Ollis Real Estate & Auction, LLC or its agent liable when your costs or fees are different then the contents of this explanation.

We are only going to use the State of Illinois. If you are buying real estate or live in another state know that each state and county has their own laws and customs. Any of the following costs can be negotiated on the Contract for Sale of Real Estate to be paid by either the buyer or seller, we’ve organized it more traditionally for who pays for what.

The following are some basic closing costs explained for the seller. Be AWARE that every single real estate transaction is different and no two are alike.

The contract sales price is the “gross price” for what you are willing to take for your real estate. Personal property negotiated into the real estate sales contract does not have a value, as the personal property becomes part of the real estate. If you want to sell other personal property not negotiated into the real estate contract it should be handled by a separate personal property contract or a bill of sale.

The closing fee is charged to coordinate the actual closing. The base closing can average $300. Customarily the fee is split 50/50 between buyer and seller. IF the buyer is getting a loan the seller should not have to pay a closing fee IF the bank is doing the closing.

Title insurance is based upon the contract price and is charged so much per thousand. This price per thousand depends upon the company used. For our example, below we’ll use $3.50 per $1,000. The seller provides the buyer with an owner’s title insurance policy.

The title search cost is for the research on the real property and the sellers. To help the title company, your abstract or previous title policy should be provided before the work begins. Cost for the search will vary, with a minimum of around $350.00.

Title Examination fees start around $350 and go up. This is for review of the findings of the title search.

The Title Insurance Binder is a commitment to issue an owner’s title policy. The Binder will show what is necessary to issue clear title policy to the new buyer. Cost is about $25

IL CPL is short for Illinois closing protection letter. The CPL is provided by the title company and is taxed by the State of Illinois, seller pays $50.00, buyer pays $25.00 and lender fee $25 which is paid by the borrower.

IL Title Reg is short for IL Title Regulation. The State of Illinois collects $3.00 for each policy written. The seller pays for the Owner’s Policy; the purchaser, if they are borrowing, pays for the Mortgage Policy.

The seller provides the buyer with a deed & PTax. The deed conveys the land from seller to buyer. The PTax record the price and amount of stamp taxes. These are prepared by an attorney, with an average starting cost of $120.00. It depends what attorney prepares the deed and how complicated.

Commission & Advertising is probably going to be your largest expense and will vary with company and price of real estate. This will be negotiated when you list your property. Normally commission is a percentage, be aware that in Illinois a minimum commission must be on the listing agreement.

State, County, & City Transfer Stamp Taxes are placed on the deed when recorded. State stamp tax is $1.00 per thousand. County stamp tax $.50 per thousand. Most towns in Southern Illinois do not have a city tax, but every single town is different.

The seller gives the buyer a credit for real estate taxes, on the closing statement. Illinois real estate taxes are paid in arrears, your 2015 taxes were paid in 2016 and your 2016 taxes are paid in 2017. Prorated real estate taxes are the previous year’s unpaid taxes and the current year up to the date of closing. The amount prorated generally comes from the current taxes. If the property is being changed somehow, the county assessor’s office can approximate the assessed property value and provide an amount.

Most properties being sold will not need a survey, because the legal description is not being changed. Surveys are necessary when changing the legal description of real property. The only people able to rewrite legal descriptions are surveyors. Survey costs vary greatly, as it depends what is being surveyed and how it is being divided. Most of the time sellers provide buyers with a survey, however sometimes the cost is split 50/50 between buyer and seller.

Your mortgage is recorded at the courthouse. If you have paid your mortgage off, a release of lien should be recorded. If your release is not recorded, you must request the release from the bank. If you still owe the bank only you can get the payoff, unless the title company has signed written permission from you. Also, the payoff will need to be figured for about a week after the set closing date, in case something happens. If your bank collects money to pay for your taxes or insurance, it is up to you to find out if your payoff includes the amount or if your bank is going to send you the money. Every bank is different and they will only tell you, because it is confidential information.

Liens against the real estate must be paid. Final payoff amounts will need to be obtained by you or written permission to the title/closing company. Release of liens need to be sent to the closing company and they record them at the courthouse. If you disagree with a lien or believe you can get it reduced, you or your attorney need to get it taken care of immediately.

To record anything at a county clerk’s office there is a fee, which is different in every county. Most have a flat fee for a specific number of pages and then a per page fee after the specific number is reached.

If you cannot be at closing, then everything can be mailed or emailed to you. Almost all the documents will need to be notarized and then overnighted back, by either UPS or FedEx, the closing company must have the originals. Courier fee starts around $25.00.

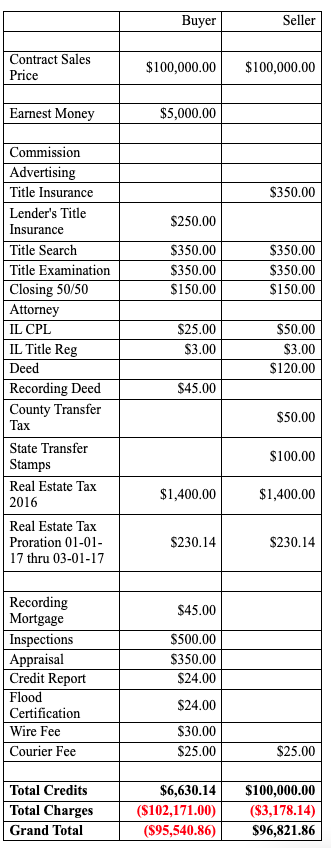

The following is NOT what an actual closing statement looks like, we are only providing this so you can see a visual of the numbers. Please remember almost all fees are not fixed, and we can help you with understanding this process.